Many organizations are not aware of their true cost savings potential, because insurance providers only focus on a single aspect of their Total Cost of Risk: the cost of insurance.

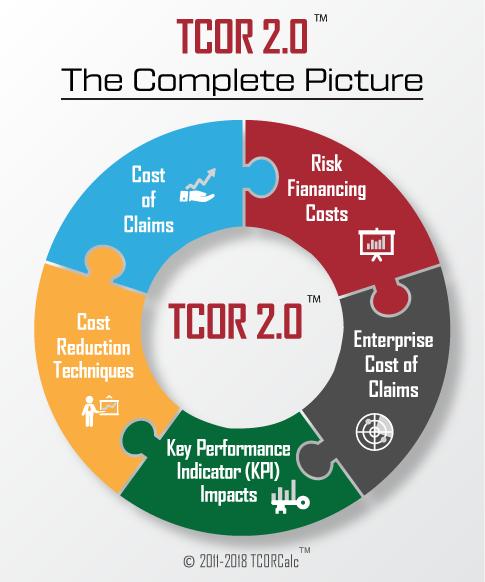

For the record, the cost of insurance is the smallest part of your risk management cost structure. The majority of your out of pocket expenses comes from your retained cost of claims (deductibles, self insurance, or uncovered losses), and the enterprise cost of claims (the hidden expenses absorbed by your organization during a claims event).

Quantifying your Total Cost of Risk creates opportunity for risk control and cost reduction strategies that may significantly reduce your expenses.

If you haven’t quantified your true Total Cost of Risk (the complete picture), you may be miscalculating your risk financing and making incorrect budgetary decisions.

As Certified Analytic Broker™ we’re uniquely qualified to provide in-depth assessment of your existing cost structure. Moreover, we can assemble a plan to improve your financial results going forward. But, first things first, you must know your numbers!

Contact us today